Zero Hedge has often been critical of the administration's current policies, which are not unique or novel, or even sufficient, as many claim, to prevent a relapse based on a confluence of economic events that pushed the country into the Great Depression, and can be simply qualified as

inflationary spending and credit bubble reflation. By peddling debt at even cheaper rates than the much maligned Greenspan did during the great initial credit bubble inflation, what is happening right now does not differ one bit from the scenario that brought us here. Attempting to set the basis for a true bull market by Obama would look totally different, most notably the elimination of massive amounts of debt to the pain of existing equity holders. Of course, that would never happen as those very equity holders are the bulk of his voting constituency and what politician cares about doing the right thing instead of getting reelected? But that is not news to anyone.

What would, however be newsworthy, is a comparison of the current market which has at this point become a speculative day trading casino, with the one, which in the early 1980s lead to a multi generational bull market, however ultimately fed by the same credit binge that has led us to our current predicament. For that purpose i present a great analysis done by highly insightful and contrarian folks over at

contrary investor. The observations are stunning.

***

You already know that since “the bottom” in the equity market back in early March, the cries have grown ever louder with each passing point higher on the major equity averages that a major stock market bottom has been reached and a key turn in the economy is at hand as many an economic stat of the moment shows stabilization in rate of change deterioration for now. Moreover, we’ve seen a number of stock market extremes in recent months that we have to admit are generational in nature.

Has a major inflection point on the downside been achieved? It’s been a very long time since we’ve done a little compare and contrast with major economic and equity market lows in the annals of historical experience. You already know that the prior true market and economic bottom of substance was seen in the early 1980’s. Prior to that the next secular low we really trace back to 1949. From 1949 through 1966 the markets enjoyed one heck of a bull run. And then it was really a “running in place” exercise for equities in the macro sense until 1982, with a lot of tradable up and down volatility along the way, but no point-to-point progress from 1966 to 1982. That’s our version of life as we survey history. So we thought we’d look back at some data for a little compare and contrast as no one really knows the answer to the question as to whether the equity market and economy have been or are bottoming at the moment . Everyone is guessing. We’ll only know for sure in hindsight.

We believe the important point of this exercise is not pinpoint data comparison with a prior and in hindsight clearly identifiable market and economic cycle low, but rather a total package look at life. True economic and market lows are made up of a multiplicity of factors all coming together at once to set the infrastructural stage necessary for a real domestic/world economic and equity new bull market recovery. In the following table we take a quick peek back at the prior now oh so clear secular 1982 bottom. We’d also look at the major 1949 low, but most of the Fed data we used in the table below simply does not stretch that far back. We divide up the data retrospective into credit market numbers, household financial character circumstances, headline interest rate and inflation factors and very generic equity market markers. Have a look and we’ll have a few comments.

We won’t dwell on the credit market stats as the dichotomous compare and contrast exercise is virtually self-explanatory. As we have harped on in the past, US credit cycle dynamics since the early 1980’s has been responsible for and underpinned corporate earnings growth, GDP expansion and asset value inflation. Back in the early 1980’s, the US economy as a whole was nowhere near as levered as we now experience. The secular rise in interest rates from the 1950’s to the crescendo in the early 1980’s made debt quite the expensive luxury, or necessity as the case may be. But secular disinflation and the coincident fall in cost of debt capital over close to the last thirty years allowed the US economy to lever up significantly. Can a bull economy really start from this level of current leverage? And of course the question of a bull economy has direct implications for an accompanying bull in macro equities. US systemic leverage circumstances today are night and day compared to what we saw in the early 1980’s. The dynamics of peaking cost of debt capital accompanied by a reasonably levered at the time US economy was the critical infrastructure in place at the time that was the breeding ground for one of the longest economic and equity bull market cycles in history. Today circumstances stand in polar contrast. Cost of debt now stands at generational lows and systemic leverage at generational highs. We humbly suggest that the leverage and credit market infrastructure is not currently in place to support a secular low in equities and the economy. It seems only common sense that from our current circumstances, secular change in leverage should fall and long term cost of debt capital should rise. Exactly the opposite of secular environmental circumstances of 1982.

US households have been a key driver of the multi-decade US credit cycle. Again, circumstances of the moment are completely different than was seen at the last secular low of substance. As a very quick and powerful note, we need to remember that in early 1982, US households held very little in the way of equities. Today you can see the number stands at 17 % of household net worth, but we have to remember this is down from 25% a few years ago as a result of market value contraction since that time. Moreover, this number does not include IRA’s, 401(k)’s, etc. The baby boom generation has been the generation of equity ownership, starting with very little exposure to now significant exposure (inclusive of the qualified plan money). This will not repeat itself again and was a key demand driver of the last three decades.

Interest rates and inflation? Fed interest rate flexibility has been used in its entirety. In 1982, vast flexibility was in the hands of the Fed in terms of being able to shape economic and financial market outcomes vis-à-vis monetary policy. No more and never again anytime soon. For all intents and purposes, headline inflation has been completely rung out of the system…for now. All of the potential for lowering interest rates and riding a powerful wave of disinflation wildly supportive to real economies and financial markets (including valuations) is behind us, not in front of us.

Finally, we’ve used the Bob Shiller historical S&P P/E data as valuation markers for equities in this little compare and contrast exercise. S&P yields have been climbing as of late, but from very low points in prior years. Moreover, clearly getting in the way here has been meaningful dividend cuts or outright elimination over the last year. This is not about to stop any time soon. Point being, we’re on our way, but at nowhere near equity character secular lows of historical note. Simple enough. Likewise, although P/E multiples are now very low relative to recent period experience, this assumes earnings trough now, which is not necessarily a given. You can also see that Shiller P/E numbers even after the already in place contraction are twice what was seen at the secular lows of 1982, not that these secular low P/E's are a prerequisite for bull markets, but they sure do help in terms of framing potential risk/reward outcomes.

Okay, enough. Is the world about to come to an end because of the apparent data point dichotomies you see in the table? Of course not. Do these numbers mandate equities are to “bleed out” ahead? In no way. But what they do tell us is that the necessary total package infrastructure is not in place to support what could be defined as secular low points for the equity market or the real economy. That says to us that as we move forward, caution, sector, and asset class specific focus remains critical. Simply, we do not believe we are in an environment like the early 1980’s where the secular tide to come is about to lift all boats. That’s all. Not good nor bad, simply the context against which we need to make decisions. We just need to understand and “see” the character of the investment playing field in front of us. Simply, it's not the same playing field we saw in 1982. One last comment that is surely obvious. What does make the current environment critically different than 1982 is the stimulus now being supplied primarily to the financial sector and credit markets, a minor part of which is direct economic stimulus. We are in uncharted waters as far as US debt acceleration, money printing and forward financial guarantees are concerned. Of course what we are talking about above is the nuts and bolts credit market and macro financial circumstances of the moment. It's against the polarity of the here and now stimulus will either succeed or fail.

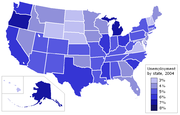

Before pushing on, one quick chart. There exists yet another differential we believe is key to our present circumstances in light of the fact that the US will need to issue very substantial Treasury debt ahead. The following chart needs very little explanation, no?

We didn’t think so. With each passing year, the US economy has increasingly been “financed” by the foreign community since 1982. Will this continue ahead? We currently stand in quite the contrast to 1982 as far as the US financing its economy goes. Quite the contrast.

There you have it. In case you were wondering, we’ll spell it out for you. Personally we do not believe the infrastructure components are currently in place to support a new secular bull market, despite the S&P and equity index friends essentially going nowhere point-to-point over the last decade. But that certainly does not mean there are no investment opportunities. Quite the opposite. What these numbers tell us is that a reconciliatory period for the US will probably extend for years, meaning volatility will be a fact of life. Secondly, we simply need to think and act differently ahead relative to correct behavior in the secular equity and economic bull of the 1982 period to date. The context of the global is the reference point from which we need to work. Circumstances today are different than the prior equity and economic secular lows. Not bad at all, but different. This is the very thinking which will shape our actions ahead.

Thursday, May 28, 2009

Thursday, May 28, 2009

Jay

Jay